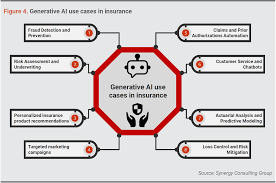

Real-World Examples of Generative AI in Insurance

Several insurance companies have already begun harnessing the power of generative AI to enhance their operations and customer experiences. For instance, Lemonade, a tech-driven insurance company, uses AI to streamline the claims process. Their AI system, known as Jim, can process claims in seconds by analyzing data and identifying valid claims, providing customers with near-instant resolutions.

Another example is Allstate’s use of AI to optimize pricing models. By employing generative AI, Allstate can analyze a wide range of variables, such as driving behavior and environmental factors, to offer personalized premiums. This approach not only ensures fair pricing but also improves customer satisfaction by offering tailored solutions.

Additionally, Zurich Insurance Group has implemented generative AI to enhance its risk assessment capabilities. By leveraging AI-driven insights, Zurich can identify potential risks with greater precision, allowing them to offer more competitive premiums and improve their overall underwriting process. These real-world applications highlight the transformative potential of generative AI in the insurance sector https://dedicatted.com/services/generative-ai/insurance .

Challenges in Adopting Generative AI for Insurance

Despite its numerous benefits, adopting generative AI in the insurance industry is not without challenges. One of the primary obstacles is data privacy and security. As AI systems require access to vast amounts of sensitive data, insurers must ensure that robust security measures are in place to protect customer information. This necessity for stringent data protection can complicate the implementation process and increase costs.

Another challenge is the integration of AI systems into existing infrastructures. Many insurance companies still rely on legacy systems that may not be compatible with modern AI technologies. Upgrading these systems can be costly and time-consuming, posing a significant barrier to AI adoption. Furthermore, the need for skilled personnel to manage and maintain AI systems can add to the complexity and expense of implementation.

Lastly, there is a risk of over-reliance on AI systems. While generative AI offers powerful insights and automation capabilities, it is essential for insurers to maintain a balance between human judgment and AI-driven decisions. Ensuring that AI systems complement, rather than replace, human expertise is crucial for maintaining customer trust and delivering high-quality services.

The Future of Insurance with Generative AI

The integration of generative AI in the insurance industry is set to revolutionize the way insurers assess risks and engage with customers. By offering more accurate risk assessments, personalized services, and enhanced fraud detection, generative AI presents a compelling value proposition for insurers looking to stay competitive in a rapidly evolving market.

However, to fully realize the potential of generative AI, insurers must address the challenges associated with its adoption. Ensuring data privacy, updating legacy systems, and maintaining a balance between human and AI-driven decisions are essential steps in this journey. By overcoming these hurdles, insurers can unlock new opportunities for growth and innovation.

As generative AI continues to advance, its role in the insurance industry is likely to expand further. Insurers that embrace this technology early will be well-positioned to lead the industry into a future characterized by greater efficiency, customer satisfaction, and resilience. For those interested in learning more about how generative AI can transform their insurance business, now is the time to explore its possibilities and begin the journey towards a smarter, more agile future.